Pricing models

Contents

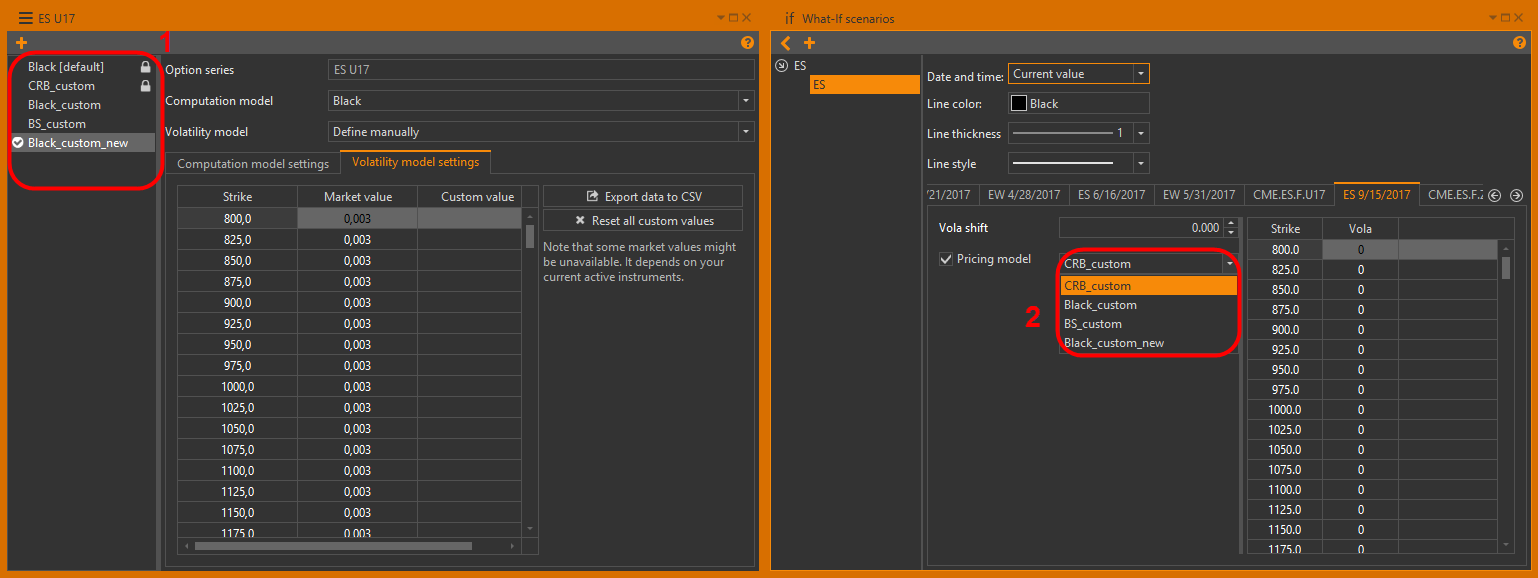

Option prices, Theta, Vega, Gamma, and Delta parameters are calculated using the current option series' pricing model. You can create multiple models for each series of options and customize them in various ways.

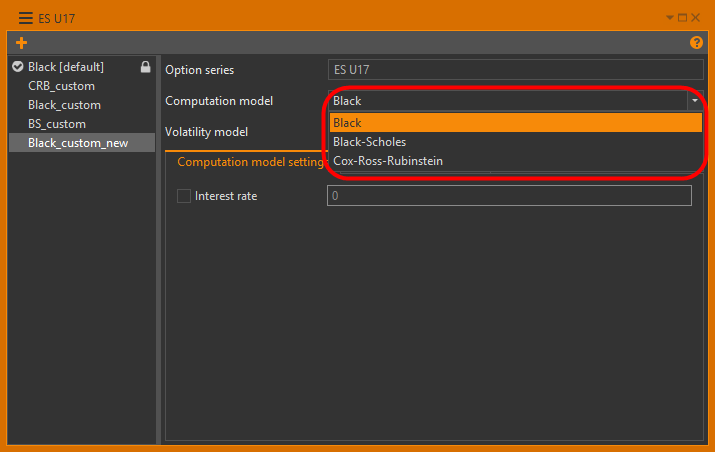

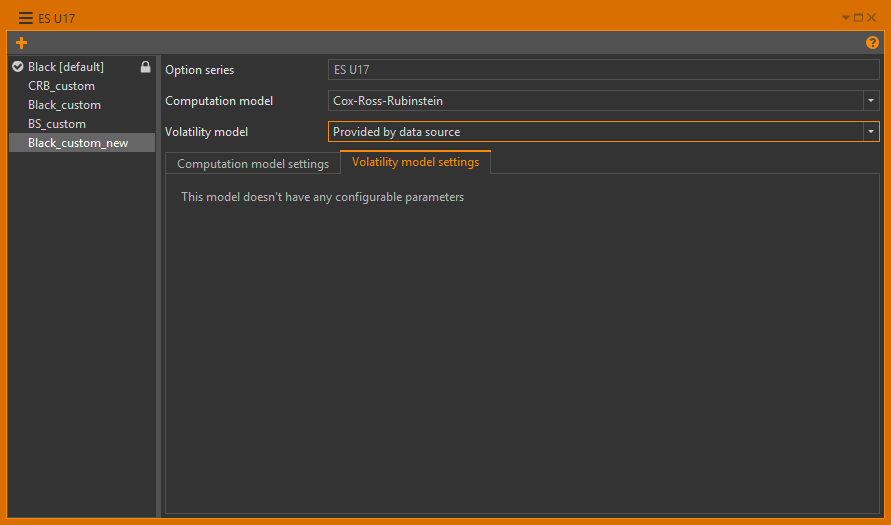

The pricing model consists of two parts – a basic model (Black-Scholes, Black, Cox-Ross-Rubinstein) and a volatility model. You can combine these models and set different parameters for each of them.

By default, equity and index options are priced based on the Black-Scholes model, and options on futures use the Black model.

The volatility values are taken from the data source.

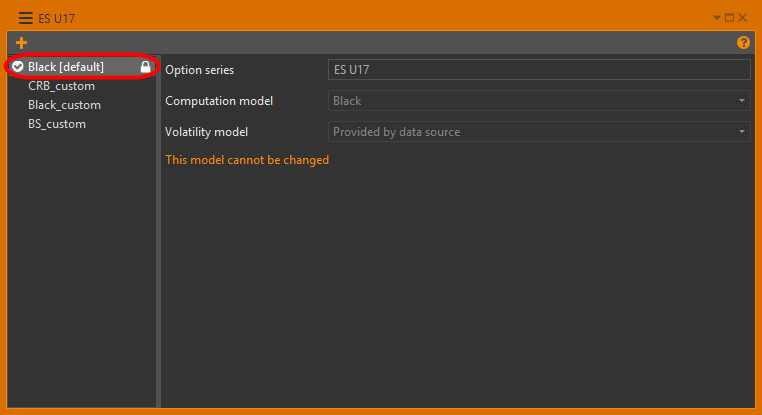

These models are not available for editing (indicated by [default]) and deleting (marked with ![]() ).

Other models can be started or stopped at any time.

An active (running) model are marked with

).

Other models can be started or stopped at any time.

An active (running) model are marked with ![]() icon.

icon.

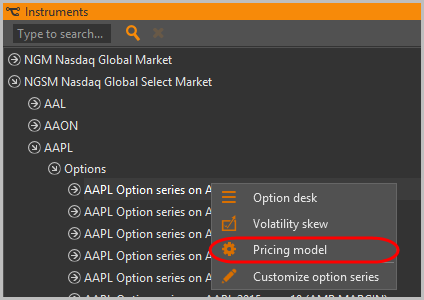

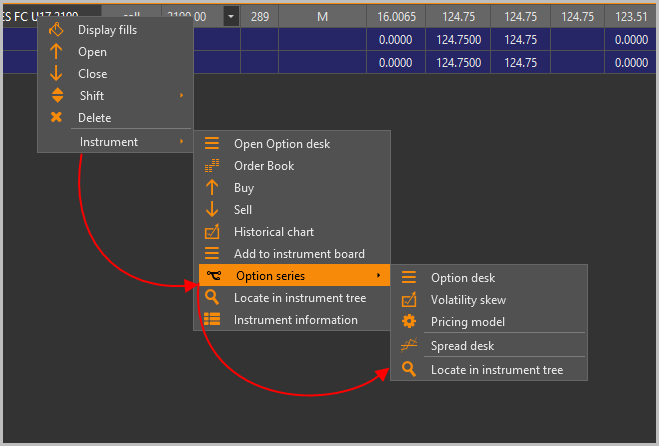

In order to set up a model for a specific option series, open its context menu by right-clicking its name in the series list and selecting the Pricing model command. This command is available in the Option Series submenu.

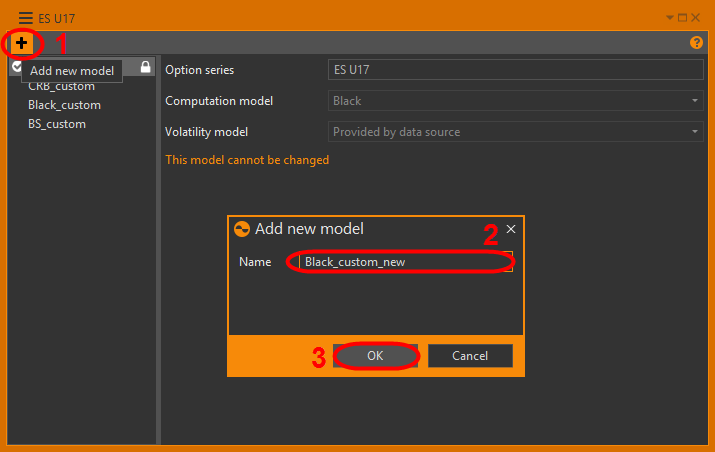

Creating a pricing model

To create a new model, you need to click the Add model button. In the open window, enter a name for the new model.

Next, choose the computational and volatility models and set the necessary parameters.

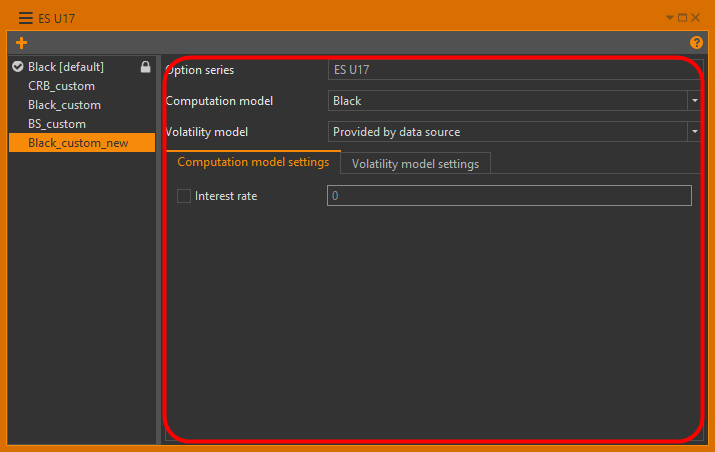

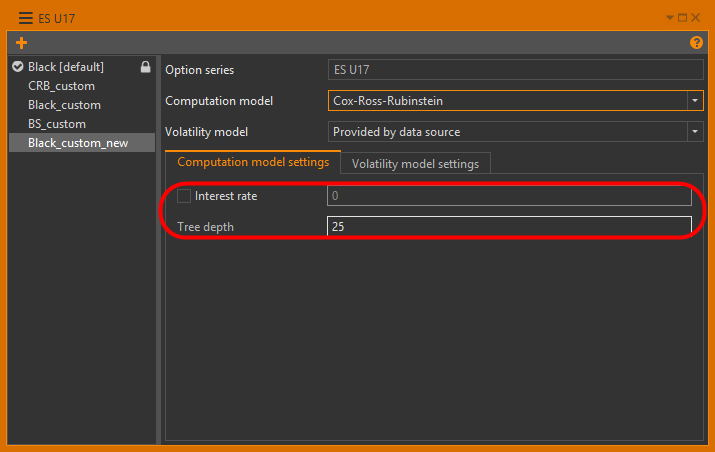

The base model settings

You can select the base model from the Computation model list.

In Computation model settings tab, the parameters can be set for this model.

For the model, you can specify:

- Black – interest rate;

- Black-Scholes – interest rate;

- Cox-Ross-Rubinstein – interest rate and tree depth. To enter the interest rate value, check the checkbox.

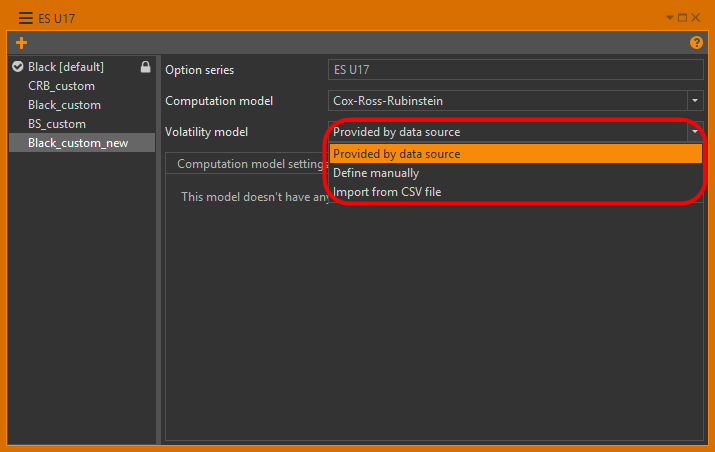

The volatility model settings

You can select the volatility model from the Volatility model list. Available volatility models:

- Provided by data source – the volatility values are calculated automatically in OptionWorkshop, the model is not available for editing;

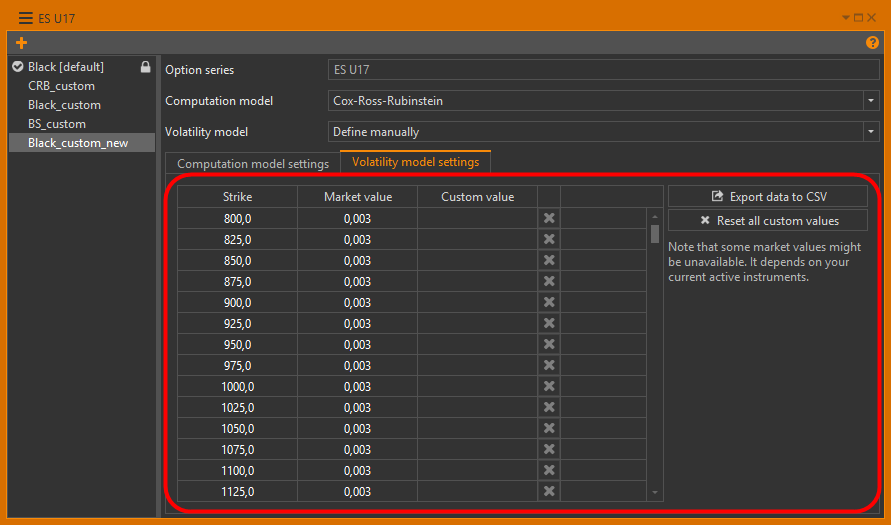

- Define manually – user can set custom volatility for each strike;

- Import from CSV file – the values of volatility are uploaded from your CSV file.

Provided by data source

In this case, the volatility values are calculated automatically in OptionWorkshop.

Define manually

If you select this model, the Volatility model setting tab will display a table with a list of the strike prices and the volatility values.

To override option volatility for the specific strike prices:

- Double-click on a cell in the Custom value column.

- Enter the desired volatility value into the corresponding row in the parameters table.

Custom values will be shown on the volatility skew. The table can be exported to a CSV file by clicking the Exsport data to CSV button. You can edit this file (replacing the default volatility values) and then use this file for the Import from CSV file model.

To reset the custom volatility values, click the Reset all custom values button.

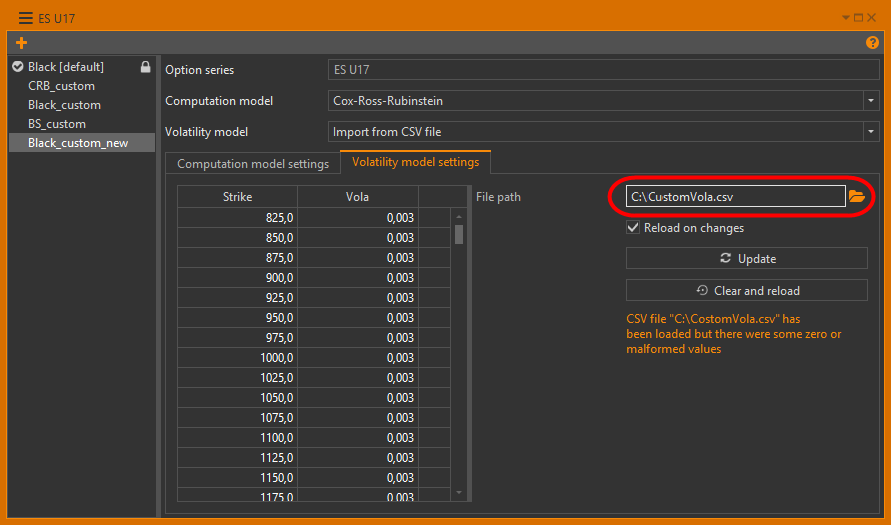

Import from CSV file

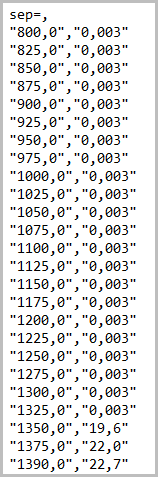

In the settings you need to specify the path to the text file, in which the volatility values for each strike are specified.

The csv file contains two fields separated by a comma “strike”, “volatility” on each line.

The buttons mean:

Reload on changes – if this is checked, then the table is updated automatically each time you modify selected CSV file;

Update – forces the table to update. This is only needed if “Reload on changes” is not checked;

Note that if you remove some strikes from a CSV file the model will use last known values for them.

Clear and reload – clears the table and reads in values from the CSV file again.

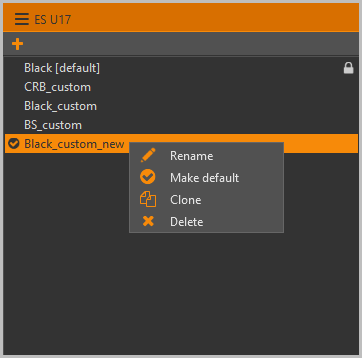

Management models

Right-clicking on the model opens the context menu with a list of commands:

Rename – changes the model name;

Make default – activates the model;

Clone – creates a copy of the model;

Delete – deletes the model;

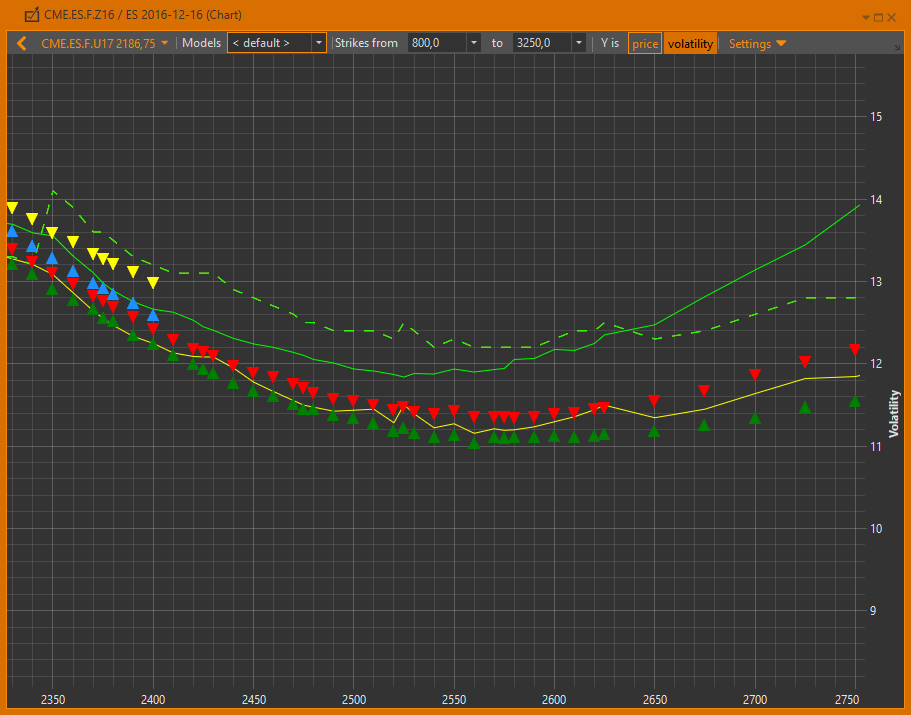

Volatility skew

On the volatility skew chart, there is an additional model curve that can be built from custom values configured in pricing model settings. The skew is shown by a dashed line.

What-if scenario

You can select a pricing model for the what-if scenario only from the list of created models for this option series.

Models cannot be deleted as long as it is being used in what-if scenarios.