Futures Order Stairs

Contents

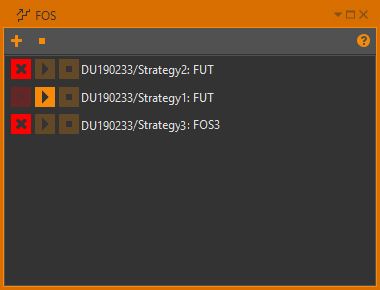

FOS is designed to place orders on futures and options automatically and to make profit on price fluctuations in the specified range. The idea of FOS is to create a grid of bids and asks. When an order is filled, the system places an opposite order at the neighboring price.

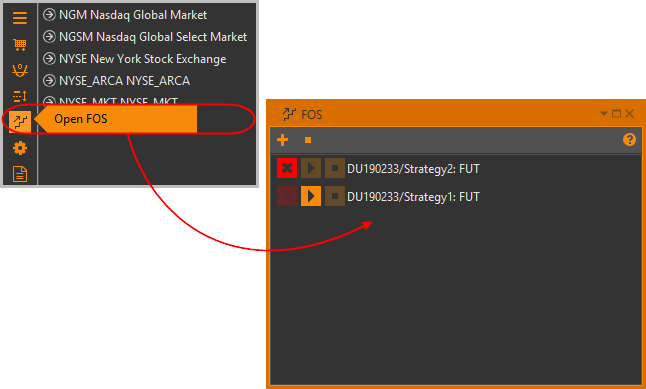

To open the FOS Manager window, click the  button.

button.

Right-click on the desired stair to open a commands list, where you can:

- Open the stair settings window;

- Start FOS;

- Stop FOS; and

- Delete FOS.

Some commands might be unavailable. To activate them, open the settings window by double-clicking on the stair name.

General operations

Create a new stair

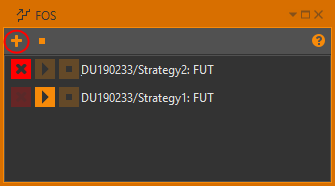

To create order stairs:

Click the

button on the top toolbar of the FOS manager window.

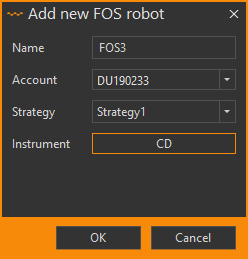

The Add new FOS window will open.

button on the top toolbar of the FOS manager window.

The Add new FOS window will open.

Enter the FOS name in the text field.

Select an account.

Any number of order stairs can work on the same trading account, but on different strategies.

Select a strategy or enter a strategy name in the text field. If a strategy with the specified name does not exist in the selected account and portfolio, then it will be created.

Note that you cannot create one on actual strategy.

Select an underlying asset.

Click the OK button or press the Enter key.

The new Order stairs will appear in the FOS list.

Start FOS

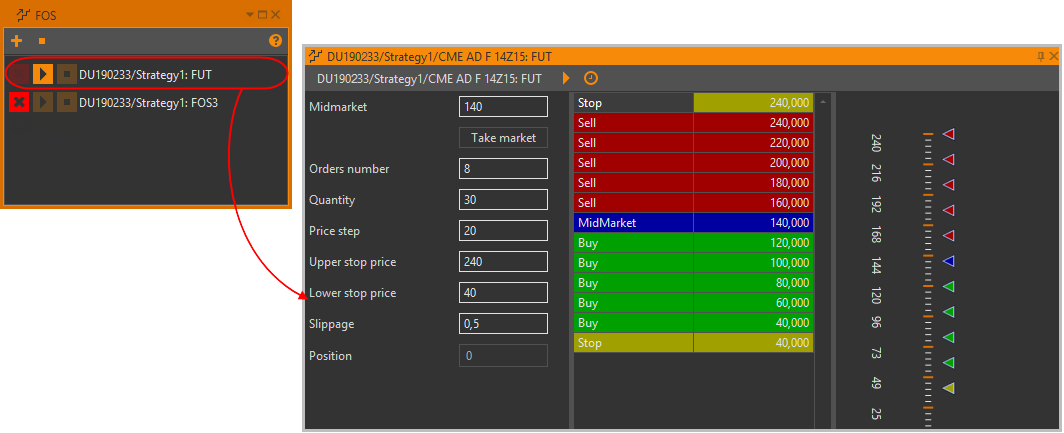

To start FOS you need, double-click on the stair’s name.

After the Settings window opens, click the  button in the top toolbar.

button in the top toolbar.

When an order is filled, the midmarket is set to the order price. An opposite order is placed at the previous midmarket. The fills generated by FOS are accumulated in the FOS strategy. A process of automatic trading is determined by the set of parameters (see FOS parameters).

Stop FOS

To stop trading, click the  button.

button.

Delete FOS

To delete FOS, click the  button.

button.

FOS parameters

FOS is configured using the following parameters:

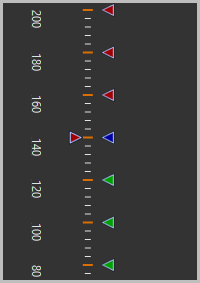

Midmarket – base price to place orders from. The Take market button sets the midmarket to current market price

Orders number– number of orders of each direction in the grid

Quantity – order size

Price step – step in the order grid

Upper stop price – upper price to stop FOS at

Lower stop price – lower price to stop FOS at

To deactivate Upper stop price / Lower stop price parameters you need to specify

0value.Slippage – order price offset to the best price. This parameter affects orders placed to close current position. The position is closed when FOS is stopped at any of the stop prices

Position – current position

When you enter parameters, an order stairs is created.

The scale shows the current price  ,

orders to buy

,

orders to buy  and to sell

and to sell  ,

and the stop price

,

and the stop price  .

.

When an order is filled, the system places an opposite order at the neighboring price.

When the Upper/Lower stop price is reached, FOS will be stopped and the current position will be closed at the market price (with respect to the Slippage parameter). All the fills generated by close position order will be displayed in the FOS strategy.

Schedule

FOS supports activity scheduling. You may read more about it in the Schedule.