Weekend readings, 2016/12/24

How to Make 40% a Year Betting on the Market, Even if it Doesn’t Go Up

Here is the trade I made last week when SPY was trading about $225:

- Buy to Open 1 SPY 19Jan18 220 put (SPY180119P220)

- Sell to Open 1 SPY 19Jan18 225 put (SPY180119P225) for a credit of $1.95 (selling a vertical)

Vertical put (bullish call spread) strategy to gain 40% in 13 months

http://www.terrystips.com/blog/how-to-make-40-a-year-betting-on-the-market-even-if-it-doesnt-go-up/

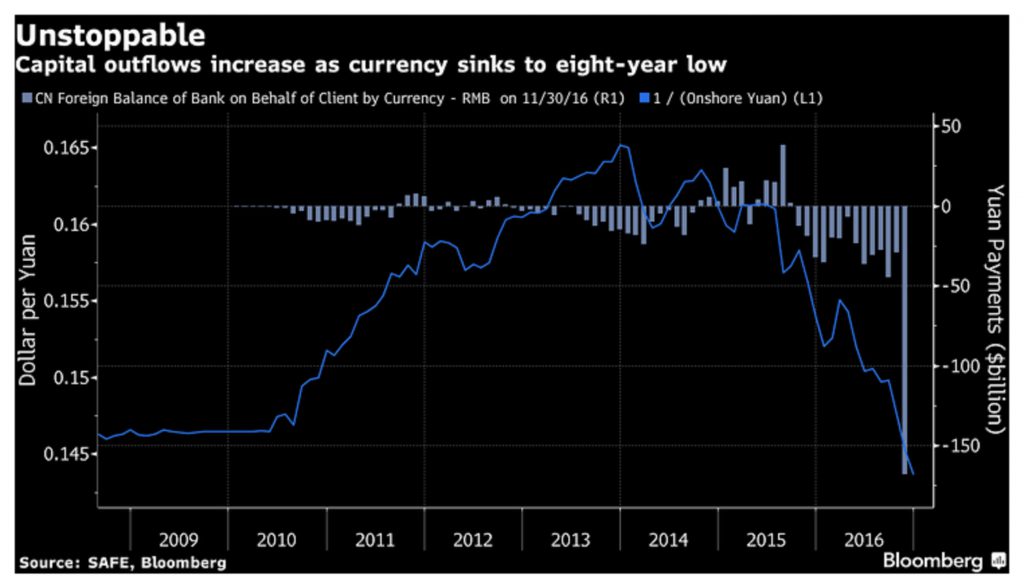

Chinese Rush to Open US Dollar Forex Accounts: More Capital Controls Coming

As the once beloved Yuan sinks deeper and deeper into the sunset, Chinese Rush to Open Foreign Currency Accounts.

A look at what’s happening with the Chinese Yuan – does not bode well for China US trade relations

The Floating Rate Loan Market: More to Consider

Investing in loans is a currently hot strategy and to some maybe even a no brainer — if rates go up, the coupon payment you get goes up so you can’t lose, right? But of course, like most things in investing, it is not that simple. We see a few challenges with this market.

Valuation, Libor floors and ability to pay are some of the potential pitfalls of investing in floating rate loans blindly

Paul Krugman: How Republics End

Here’s what I learned: Republican institutions don’t protect against tyranny when powerful people start defying political norms. And tyranny, when it comes, can flourish even while maintaining a republican facade.

A strong critique on the state of American politics, erosion of the democratic foundations

http://economistsview.typepad.com/economistsview/2016/12/paul-krugman-how-republics-end.html

Bull Trap for Nasdaq?

The initial upside breaks from the coils are faltering a little. The index showing the most vulnerability is the Nasdaq. There was some recovery before the close of business, but the damage has already been done. Technicals are still holding on the bullish side, with the exception of relative performance (against the S&P). Volume climbed to register distribution, but in holiday volume terms.

Argument for a short term top in markets, especially for the small caps and Nasdaq

http://www.markets.fallondpicks.com/2016/12/bull-trap-for-nasdaq.html

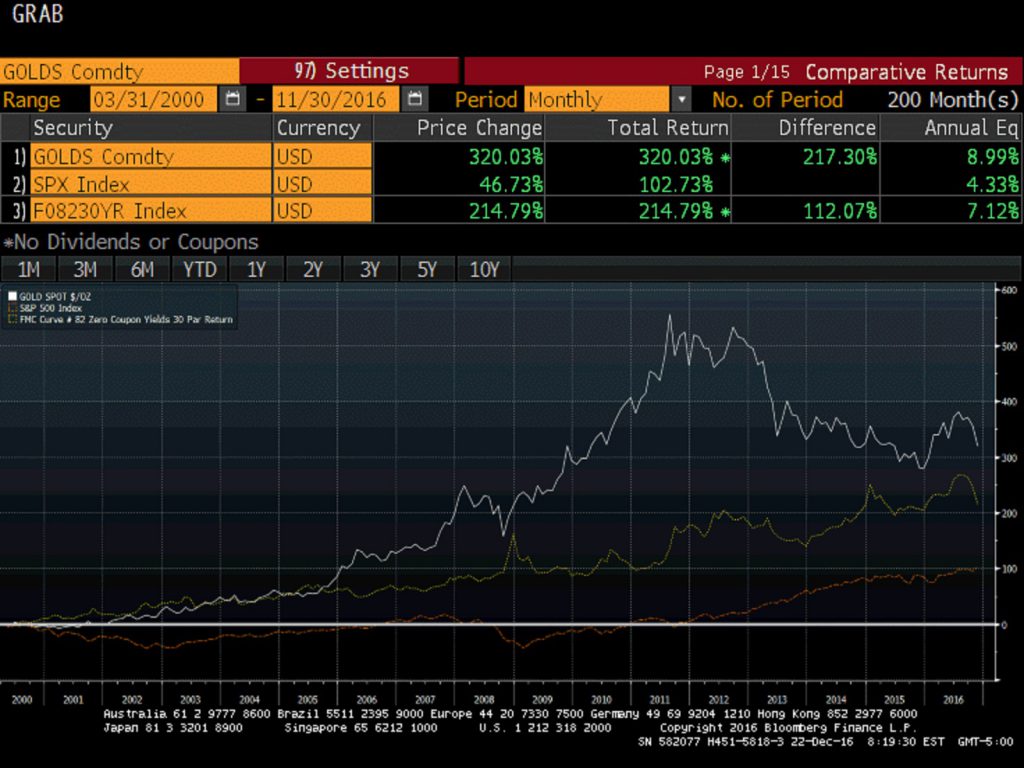

Total Returns, Gold, S&P 500, Us Treasury Bonds: Do You Really Know the Facts?

S&P 500 is the worst performing asset amongst the 3 since March 2000

Saturday, 24 December 2016