Option Workshop, version 16.12.1307

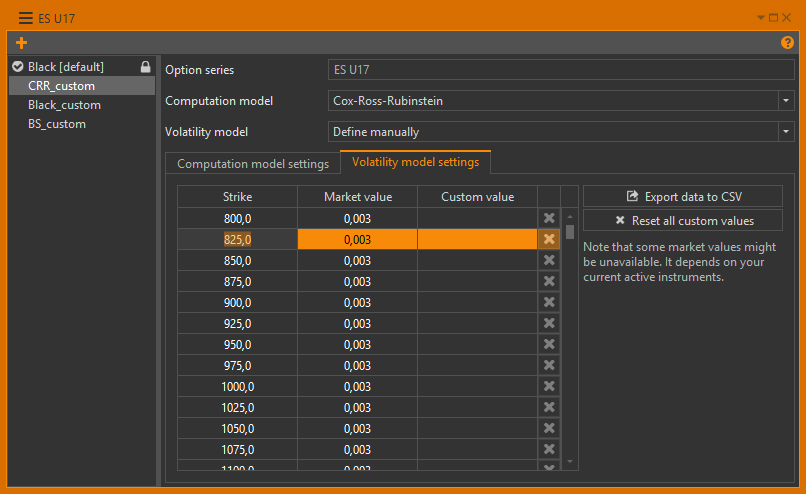

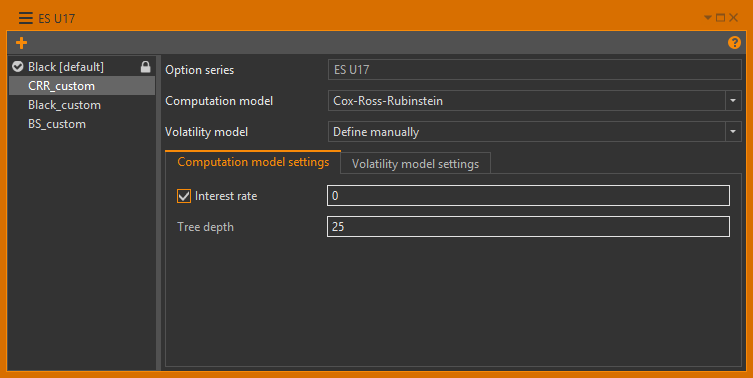

In our new version, we have changed the principle of pricing models setting. Now the model is defined as a pair of a computation model (Black, Black-Scholes or Cox-Ross-Rubinstein) and volatility model. You can create multiple models for each series of options and customize them in different ways.

In the volatility model settings, you can specify custom volatility values. Also, we have added a user-defined model line on volatility skew built from custom values in the pricing model settings.

Also, there are a few small changes in the positions table, technical support form, etc.

Pricing models

In the new version, you can create different pricing models for each option series. The model consists of two parts:

- a computation model (Black, Black-Scholes, Cox-Ross-Rubinstein).

- volatility skew model.

These models can be combined and you can set different parameters for each of them.

Available volatility models:

- Provided by data source – volatility values are provided by data source. The model is not available for editing;

- Define manually – user can set custom volatility for each strike;

- Import from CSV file – the values of volatility are taken from a CSV file.

In the upcoming updates, we will add models that can approximate volatility values around ATM strikes.

Volatility skew

On the volatility skew, we have added an additional model curve that’s built from custom values configured in pricing model settings. The skew is shown by a dashed line.

Positions manager

We have improved the positions table performance. Also, Option Workshop can now display fills and positions on instruments that have already expired.

Option desk

Now you can select your option series from the drop-down list.

Technical support

The checkboxes Include screenshot and Include log file on the Contact support form are unchecked by default.

Instruments

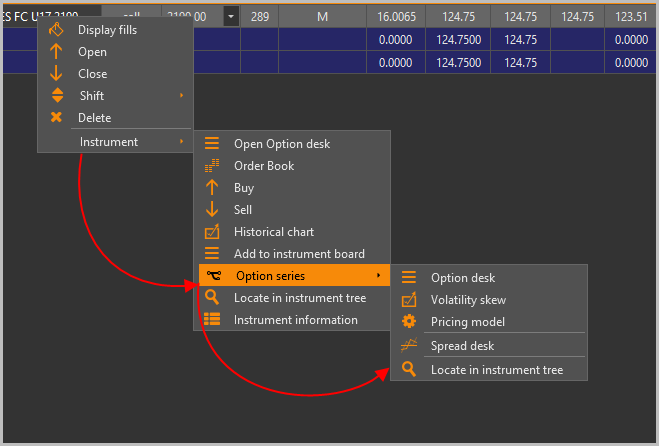

We have added an Option Series submenu into the option context menu with the following commands:

- Option desk;

- Volatility skew;

- Pricing model;

- Spread desk.

Fixed

- A crash during shutdown;

- An incorrect display of license expiration notification;

- An issue when renaming of strategy doesn’t affect a name of opened tabs.

Monday, 5 December 2016