Option Workshop, version 16.10.1194

In our new version, we have added several improvements by request from our users, and fixed some interface bugs, the DDE export bugs etc. The new version can already be downloaded from our website or through the update system.

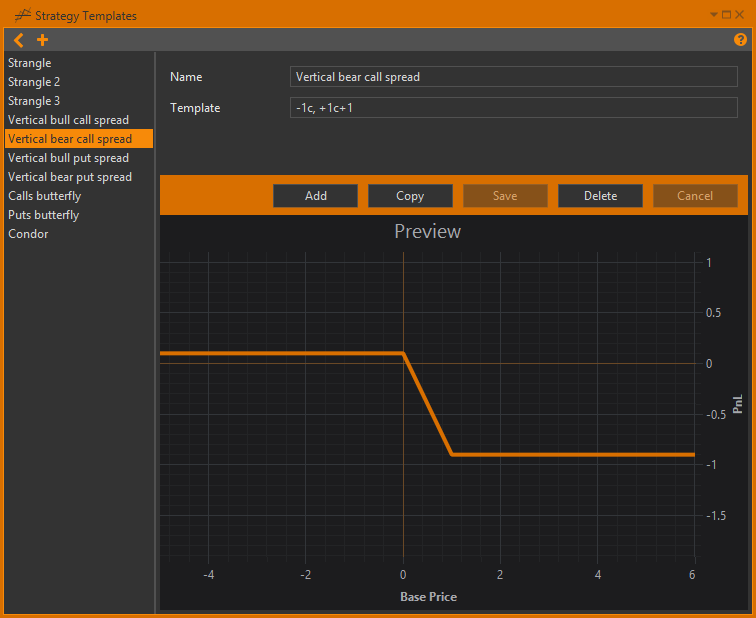

Strategy templates

In the strategy templates manager window we’ve added some standard options combinations:

- Straddle: +1p, +1c,

- Strangle: +1p-1, +1c+1,

- Strangle 2: +1p-2, +1c+2,

- Strangle 3: +1p-3, +1c+3,

- Vertical bull call spread: +1c, -1c+1,

- Vertical bear call spread: -1c, +1c+1,

- Vertical bull put spread: +1p-1, -1p,

- Vertical bear put spread: -1p-1, +1p,

- Calls butterfly: +1c-1, -2c, +1c+1,

- Puts butterfly: +1p-1, -2p, +1p+1,

- Condor: +1p-2, -1p-1, -1c+1, +1c+2.

If you select a template you’ll see in the right part of the window the template formula for creating a spread and the ‘preview’ of the PnL chart which is built up according to the formula.

Now you can include the underlying asset in the strategy templates: ‘u’ means underlying asset.

DDE export

We have added the option to change the update rate of the data exported via DDE – The Update period parameter is now available in the export settings window.

You can open the export settings window by using hotkeys Ctrl+Shift+E.

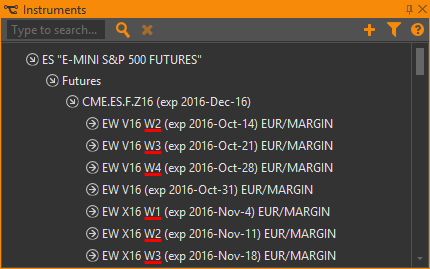

Instrument tree

Weekly options in the instrument tree now display the number of the week.

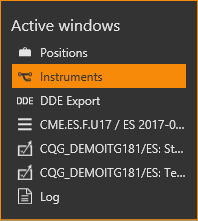

Interface control

To quickly switch between windows in Option Workshop use the hotkeys Ctrl+Tab.

Fixed issues

We have fixed an issue with:

- Interface tabs ordering not maintained after restarting the program,

- Main window’s incorrect minimization,

- Historical chart zoom settings when a candle is updated,

- Table columns’ autosizing,

- Fills deletion while deleting a position,

- Net strategy update when adding a position,

- DDE export errors.

Also Option Desk’s column preset list was not updated properly. We have fixed this issue.

Monday, 10 October 2016